Are PE Firms, Institutional Investors, and iBuyers Stealing the American Dream?

Over the past 60 days, the single-family rental (SFR) industry has stumbled into the spotlight, and by stumbled, we really mean that it crashed through the wall like Kool-Aid Man.

Private equity firms, institutional investors, and iBuyers such as Open Door and Zillow are being blamed for the insanely hot residential market and the spike in single-family home prices. But we’re living in a yield-starved world, and it makes sense that they would gravitate toward SFR.

Who’s to blame?

In April, the Wall Street Journal published an article, “If You Sell a House These Days, the Buyer Might Be a Pension Fund”. The article set off a Twitter storm lambasting institutions such as BlackRock and accusing them of driving up home prices and snatching the dream of homeownership out of the hands of hardworking Americans.

Shortly thereafter The Federalist published an article, “What Happens When Hedge Funds Buy Up Neighborhoods”. This article, which read more like an opinion piece rather than a fact-based article, asserted that renters are bad neighbors and that more renters create bad neighborhoods.

Last Friday, Vox published a very lengthy report titled “Wall Street Isn’t to Blame for the Chaotic Housing Market: the boogeyman isn’t who you want it to be.” Just as the headline suggests, the article defended the private equity firms and institutional investors involved in SFR and placed the blame squarely on American homeowners who have been resistant to new development – the people known as NIMBYs (Not In My Backyard).

And earlier this week, The Guardian got in on the action by publishing an opinion piece with the headline, “Do Millennials Really Prefer to Rent – Or Have We Just Been Cheated Out of a Proper Home?”

The author blames “untrammeled capitalism” and follows up with this statement: “Capitalism is reshaping the property market, locking younger generations out of buying somewhere to live and expecting us to be happy about it.”

Supply-constrained is an understatement

Debating the root cause of the current housing market doesn’t change the fact that over course of 2020, the median cost of a home in the U.S. increased 15% to $340,000, according to data from the National Association of Realtors. The cost to purchase a three-bedroom home is rising faster in 83% of U.S. housing markets than the cost of renting a three-bedroom home.

The U.S. does not have enough housing to meet current or future demand. It is short by 3.8 million, according to an April 2021 report by Freddie Mac. The agency found that the supply crunch increased 52% between 2018 and the end of 2020, driving up the price of homes in the U.S.

Demand is just one part of the equation. Supply is perhaps an even bigger part.

Over the past 40 years, the construction of entry-level homes has declined more than 84%, according to Freddie Mac. In the 1970s, about 418,000 entry-level homes were built annually. In comparison, only 65,000 entry-level homes were constructed last year.

Inventory turnover – the supply of homes for sale nationwide as a percentage of occupied residential inventory – was low even prior to the pandemic, according to a research note from Mark Fleming, chief economist for First American Title Co. The supply dropped precipitously last spring.

In the 1990s, 2.5% of the stock of homes were for sale in an average month. In the aftermath of the Great Financial Crisis, inventory turnover fell and never recovered to pre-recession levels, averaging 1.85% between 2013 and 2019.

During the pandemic, demand for single-family homes has skyrocketed, driven by record low mortgage rates and a wave of Millennials eager to buy homes. But sellers are hesitant, which tightened supply even further.

Between March 2020 and March 2021, inventory turnover fell from 1.53% to 1.15%. That means that earlier this spring only 115 in every 10,000 homes were for sale – a historic low.

Meanwhile, the homeowner vacancy rate – the proportion of the homeowner inventory that is vacant for sale – dropped to 0.9 % at the end of Q121, according to the Federal Reserve Bank. The last time the vacancy rate was that low, Dwight D. Eisenhower was president, NASA did not exist, “At the Hop” was the top song, and Vertigo was playing in theaters.

The year was 1958.

A small percentage of the SFR segment

Single-family rental units are the fastest-growing segment of the U.S. housing market. according to John Burns Real Estate Consulting (JBREC). Over the past three years, demand has grown 30%.

Institutional-level investors have purchased only 300,000 homes since 2008. Today, they own approximately .19% of the residential real estate in the United States, according to the National Rental Housing Council (NRHC), which represents SFR companies and investors.

NRHC says there’s not one state in the country where single-family rental home companies own more than 1% of the housing inventory and only four states where they own more than .5% (Arizona, Florida, Georgia, and Nevada).

And, of the 23 million single-family rental homes in the United States, single-family rental home companies own approximately 1.16%. In 2020, a year when home sales were the highest in 14 years, single-family rental home companies accounted for less than .14% of homes purchased. When factoring in the number of homes sold by single-family rental home companies, net purchases totaled less than .09%.

Over the past year, several firms have raised money exclusively for SFR strategies, and the conversations we’re having with investors leads us to believe that the activity in the single-family market is extremely competitive and that owners are getting pushed out for mid-priced homes.

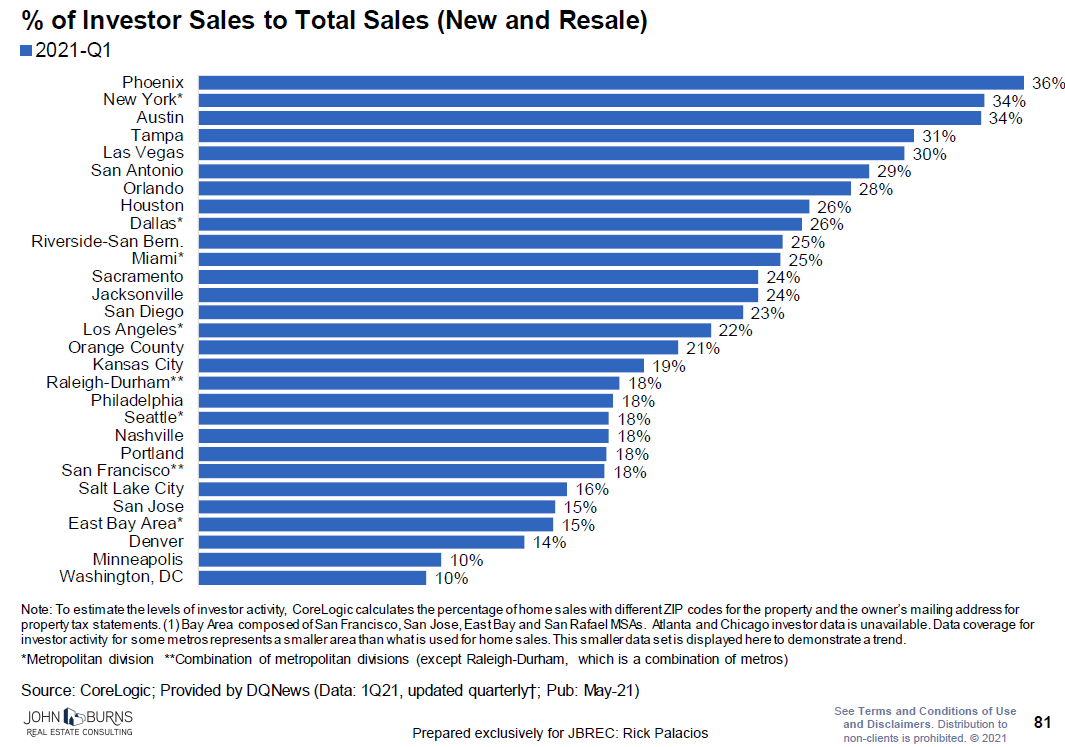

A recent chart from JBREC shows that in some markets such as Austin, Las Vegas, New York, Phoenix, and Tampa investors account for more than 30% of all single-family home sales. It’s worth pointing out that the data defines investors as owners with a mailing addresses that is in different zip codes from the acquired property.

The data also doesn’t distinguish between different types of investors, so the buyers could be individuals buying a second home, mom and pop investors seeking to expand their rental portfolios, or larger SFR investors.

Cheaper to rent … for now

Given increasing home prices, it’s actually more affordable to rent than own a home in 18 of the 25 most populous counties in the U.S. (72%) and 29 of 44 counties with populations over 1 million (66%), according to ATTOM Data Solutions’ 2021 Rental Affordability Report, which was released in January 2021.

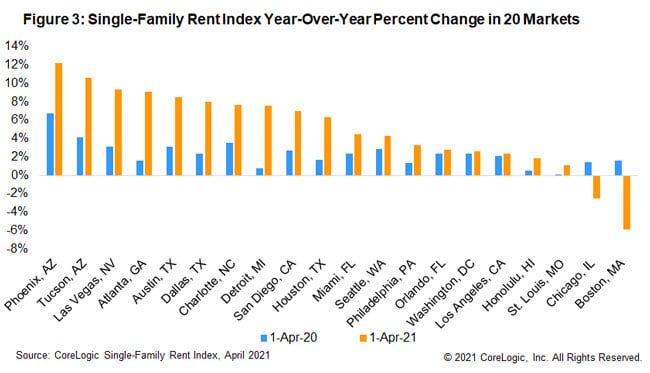

Single-family rents increased at the fastest rate in nearly 15 years in April. U.S. single-family rent growth increased 5.3% in April 2021, the fastest increase since May 2006, according to the CoreLogic Single-Family Rent Index (SFRI).

The index slowed in 2020, but even when compared with 2019, rent growth is running above pre-pandemic levels. The index measures rent changes among single-family rental homes, including condominiums, using a repeat-rent analysis to measure the same rental properties over time.

SFR rent growth has stayed positive in every recession over the past 40 years, whereas multifamily rent growth has turned negative in every recession from 2000 onward, according to John Burns Real Estate Consulting (JBREC).

Over the long run, SFR rent growth has closely tracked median household income growth since 1985, according to JBREC. Net operating margins for SFR are now in line with multifamily, resulting in attractive current cash flow for investors searching for yield. Moreover, vacancy rates in SFR properties have historically sat 2.6% lower than all other asset types.

And therein lies the appeal of SFR to investors, both small and large: there’s a lot of room for growth. According to ATTOM, SFR returns range from 6% to 10%. That’s really appealing for investors that are scrabbling for every basis point.

Like any smart investors, these new owners will more than likely push rents when given the opportunity to optimize yields. The consequence will be decreased affordability, which is already a national crisis.

Who’s really profiting?

There’s one thing that’s been overlooked in the fiery SFR debate – who’s really profiting from SFRs?

Critics say the rich are getting richer when they buy single-family homes. It’s worth noting, however, that the private equity firms and institutional investors that are acquiring SFR and benefiting from strong returns are funding those acquisitions through the contributions of middle-class Americans – teachers, firefighters, and machinists.

It’s possible that these investor groups are grabbing homes out from under the very people they count as clients. On the other hand, it’s also possible that these investor groups are fulfilling their fiduciary duty to their clients by investing in assets that provide the best returns.

But would these pensioners be supportive of this strategy if they knew that it was making homes less affordable for people just like them?

At Archer, we believe that SFR can be an important part of an investment portfolio, while acknowledging the social responsibility that investors owe to the communities in which they invest.