ROI with Archer: A Guide for Smart Investments

Investing in technology solutions like Archer represents a significant decision for any CRE firm. To gain confidence that Archer is the right solution for your business, let's dig into calculating Return on Investment (ROI) and the key initiatives CRE firms seek as they explore underwriting solutions.

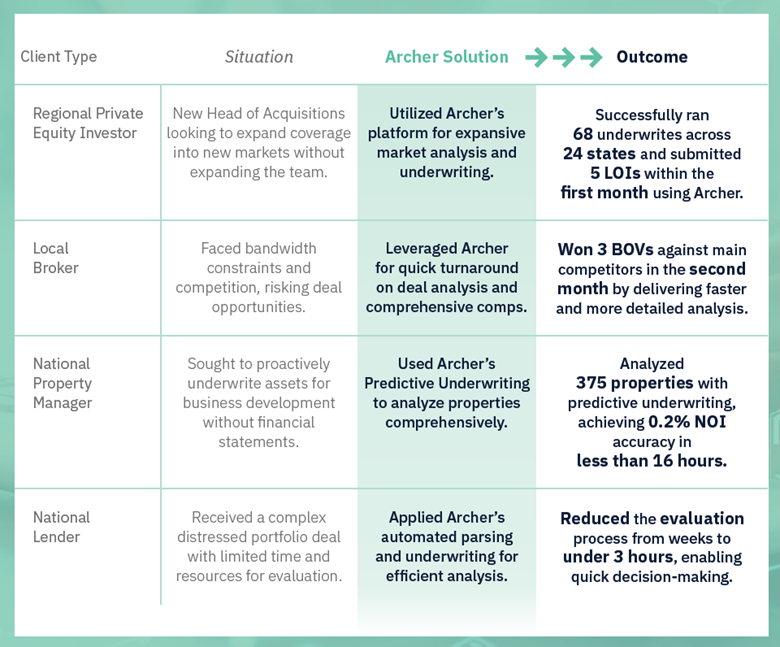

Actual Archer ROI Examples

Archer's platform supports a range of CRE firms in the multifamily space that includes investment firms, sales and debt brokers, lenders, and property managers.

Understanding Key Terms

- TCO (Total Cost of Ownership): The total cost of a product or service over its lifetime, including purchase price, implementation, ongoing support, and related expenses.

- ROI (Return on Investment): Measures profitability by showing the gains made on an investment relative to its cost. Typically expressed as a percentage.

- Payback Period: The time it takes for an investment's returns to cover its initial cost.

Key Initiatives for CRE Firms

When considering software solutions, most CRE firms prioritize the following:

- Cost Savings: Reduce the reliance on expensive human resources by automating and streamlining underwriting processes.

- Productivity Increases: Empower each analyst to cover more deals, source more opportunities, and make decisions faster with technology assistance.

- Revenue Generation: Identify and win more deals by increasing the volume and quality of analysis your team can produce.

- Data Capture: Harness proprietary data, insights, and analysis activity to improve decision-making and gain a competitive edge.

How Archer Drives ROI for CRE Firms

Archer directly addresses these key initiatives to deliver significant returns on your investment:

- Reduced Underwriting Time: Archer's streamlined process can drastically reduce time spent on analysis, freeing up human capital for strategic tasks.

- Increased Deal Flow: Analyze more deals and expand into new markets without increasing headcount.

- Improved Decision-Making: Make informed decisions backed by data-driven insights.

- Intelligent Data Capture: Track and leverage your firm's unique data to drive better deal outcomes.

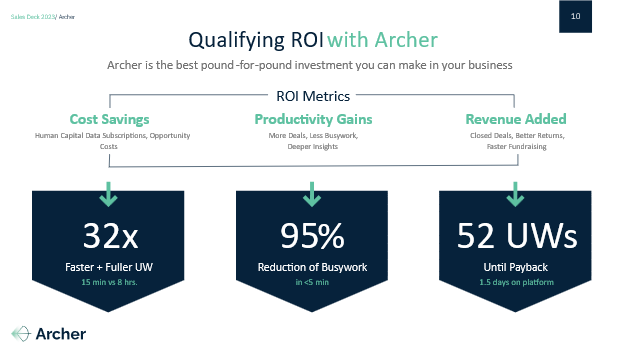

The Archer Advantage: Fast Time to Value

Archer boasts impressive metrics designed to deliver fast and measurable ROI:

Next Steps: Understanding Your Personalized Archer ROI

Getting a precise ROI projection for Archer depends on understanding how its Pricing model aligns with your unique CRE operations. Here's a breakdown of the key factors:

Client Expected Activity

- Usage & Activity: The volume of underwriting analysis, data parsing, deal flow, and overall platform usage.

- # of Users and/or Offices: The number of active Archer users and locations impacts pricing.

- Annual Transaction Volume: The total value of deals you analyze or close annually influences your investment.

- Total Properties Owned/Managed and/or Unit Count: The scale of your portfolio and potential for leveraging Archer's asset management capabilities.

Archer Products

- Core Features: The foundational modules you'll need (e.g., Data Cloud, Parsing, Comps, Underwriting, Deal Pipeline).

- Additional Modules: Additional specialized features such as Deal Sourcing, Market Analysis, Renovations, Benchmarking, Asset Management, and Loan Servicing.

Special Needs

- Custom Development: Unique requirements that necessitate tailored software development.

- Unique Integrations: The need to connect Archer with your existing tools and data sources.

- Additional Support & Training: The level of ongoing support and training your team may require.

The Best Approach - Get an Assessment

The most accurate way to understand your potential ROI and the precise pricing model that suits your CRE firm is to schedule a consultation with the Archer team. They can personalize your ROI calculation based on these variables and your firm's specific goals.

Disclaimer: It's important to remember that ROI is specific to each firm and depends on a range of factors.

Let us know if you want to further explore any of these pricing variables in more detail!