Saving Underwriting: A New Era in Comprehensive Deal Analysis

The real estate investment landscape is evolving at an unprecedented pace. With an increasing number of deals, players, markets, and the growing complexity of data, the challenge of keeping track of each underwriting decision becomes more significant. Enter 'Saving Underwriting' — Archer's newest feature, designed to revolutionize the real estate investment scene.

A Goldmine of Retained Insights

Never before has every aspect of a deal metric been so meticulously captured. "Saving Underwriting" is not just about preserving returns, it's about extracting, recording, and organizing every nuance of an underwriting decision in one accessible location. This ensures that all your critical deal insights, whether from Archer's model or your own, are preserved, structured and easily retrievable for future decision making.

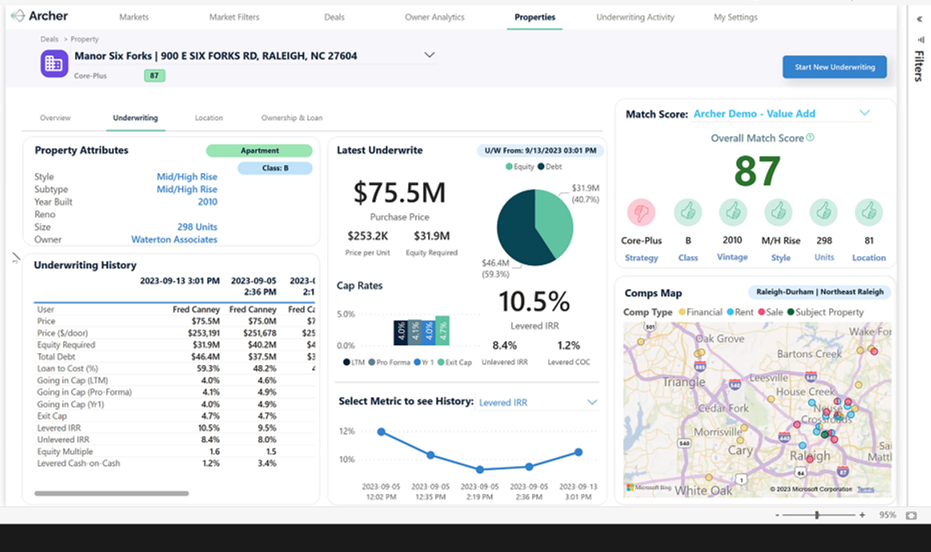

Deal Underwriting Metrics - showcasing the dynamic progress and detailed metrics of a specific deal over time.

Every time an underwriting professional evaluates a deal, numerous dynamic data points come into play – from rent growth assumptions to occupancy changes or tax estimates, to leverage or GP/LP equity splits – all of these critical to the final return estimate. These data points, when changed even slightly, can drastically impact IRRs and other return information that determines investment decisions. Previously, these critical data pieces lay scattered across various Excel models or buried within multiple versions of a file. But now, with "Saving Underwriting", every tiny bit of this information is stored, readily available for future reference.

Your Executive Control Room

Think of Salesforce dashboards or other analytical visualization platforms. These provide teams with critical insights into sales or other KPIs. Similarly, "Saving Underwriting" digitizes your team's entire underwriting activity. This isn't just about numbers or percentages; it's about gaining a holistic understanding of where your team's energy is directed, and which markets or deals are garnering the most attention.

.png?width=1441&height=805&name=MicrosoftTeams-image%20(6).png)

Deal Underwriting Activity - a heatmap showcasing regions where the team has been most active in their underwriting efforts.

A quote from Fred Canney, Archer co-founder brings home the importance of this feature:

"In the competitive world of real estate, understanding your team's underwriting activity and tendencies is the key.

It’s about knowing where you've been to determine where you're going and using that information to constantly improve your underwriting approach. That's why we built 'Saving Underwriting'."

- Fred Canney, Archer co-founder

Seamlessly Integrated into Your Workflow

The beauty of "Saving Underwriting" is its seamless integration into your daily workflow. Whether you're utilizing Archer's model or your own proprietary underwriting model, the "Save" functionality is a mere click away. This means no additional steps, no added complexities — just a straightforward solution that integrates effortlessly.

And when it comes time to re-evaluate opportunities based on updated market data or a new rent roll that is launched by the broker, updating your view of the property becomes significantly easier. With ‘Saving Underwriting”, you gain the ability to comparison with prior evaluations, track trends over time and see how various team members are underwriting the same deal. With our new feature, this becomes not just feasible, but fluid and automatic.

The Price of Lost Analysis

With the absence of such a comprehensive solution and with employee retention challenges at an all-time high, investment firms, brokers, and lenders are confronted with a glaring concern: their vast institutional knowledge, built over years of effort and underwriting, could vanish overnight when a key employee decides to leave for greener pastures. Not only is tracking team activity hard, but the loss of a key employee can lead to an even more frustrating loss of institutional knowledge and history – a significant blow to the organization.

Yet, with "Saving Underwriting", the risk of lost knowledge is mitigated. Teams are provided with an all-encompassing overview of underwriting activities, ensuring they stay ahead of the curve while a robust history of underwriting activity, insights and valuable institutional knowledge is retained automatically as activities are performed.

The Future of Real Estate Underwriting

The real estate landscape may be vast and varied, but the need for a robust underwriting solution remains universal. By bridging the gap between disparate data points and offering a holistic overview of underwriting endeavors, "Saving Underwriting" lays the foundation for a future where every decision is informed, every metric is saved, and every investment opportunity is maximized.

Reflecting on the transformative impact of Stripe in the internet payments space with something seemingly so simple, we are reminded:

With Stripe, all a startup had to do was add seven lines of code to its site to handle payments: What once took weeks was now a cut-and-paste job…giving two people in a garage the same infrastructure as a 100,000-person corporation.

In much the same vein, "Saving Underwriting" seems deceptively simple now, but its potential impact is bound to be monumental. The mission is clear: unlock the power of cohesive, data-driven insights and ensure every real estate professional is equipped to excel in this dynamic landscape.

Reach out to get started Saving Underwriting with Archer.