Valar Morghulis: All Deals Must Die

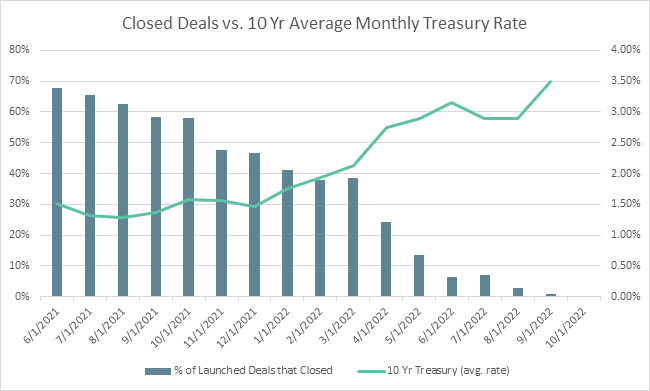

Closed deal % plummets as interest rates race upwards

Here at Archer, we love real estate...a lot. But it’s not the only thing we love. We also love a good story, especially when it includes dragons, fierce rivalries, and fights for the throne. And, in case you haven’t heard (and I’m not sure how you haven’t), there’s a new Targaryen spinoff from Game of Thrones called House of the Dragon which contains all of the above. If you are wondering, we are big time fans.

There is a line in the original series often repeated – Valar Morghulis – ‘all men must die’, which is acknowledging to the inevitability of death. It is an apt phrase for the real estate investment markets currently – ‘all deals must die’ before they can be done anew.

Archer’s massive data set and tools give us a real time pulse on the markets – whatever markets or property types we’d like to explore. This data set has enabled us to take a deep dive into how many deals are being launched, which deals are getting done (or not done), and how long it’s taking to get those deals done.

Interest rates have risen considerably over the past 12 months, and with that, there have been major challenges to getting deals done.

- For sellers, they are trying to use comps that were set during a lower interest rate environment

- For buyers, they are trying to solve to their same IRR targets with higher debt costs and uncertainty about where their exit caps might be

This disconnect has created a chasm known as a massive bid-ask gap, which makes finding a price particularly challenging.

How bad is it?

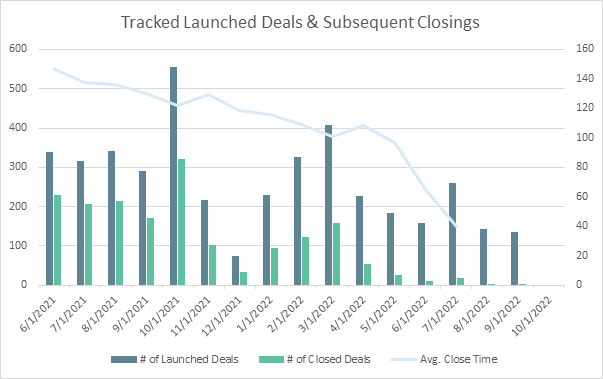

Well, based on our data tracking the top 7 multifamily real estate firms, it looks like the average close rate for deals launched in January was 47%. Of the deals launched in July, only 7% have closed. That’s a 85% drop!

Great deals still getting done

The market is not closed, however. There are still some small amount of deals getting done – and those that do are counterintuitively getting done faster than normal. Back in January, it took 116 days on average to close a deal. Deals launched in July closed in 40 days on average.

This decrease in “days to close” suggests that:

- These deals are being done with minimal impact from debt (low/no leverage buyers);

- These deals are being acquired by trade buyers (1031 exchanges) that still have urgency;

- These deals have accretive debt that can be assumed; and/or

- These deals are at a timing point where the business plan is complete/capital stack requires action and does not support holding longer.

Most other deals being explored via a marketed or off-market process are likely an attempt to test the water. Most groups that are able will likely hold out for another 6-18 months until we have more clarity around what our new normal looks like.

How Archer can help

If you’re looking to make acquisitions in this difficult environment, it’s more important than ever that you can move fast with the right information at your fingertips. Our platform can help you quickly identify which deals you’d like to chase and which are the best match for your strategy. With our accelerated underwriting, you can evaluate the deals in a fraction of the time, allowing you to screen deals and quickly determine live-time pricing, as well as which are the right opportunities to pursue and spend time on.

Given fewer deals are coming to market, investors might be looking to explore new markets or explore off-market and pulled deals to find the right opportunities. Archer’s platform can help you evaluate and research new markets. Our location recommendation tools can even help you identify markets that are similar to markets you’ve already invested in. Rather than spend weeks researching and visiting a new city to test the waters, you can research a market, evaluate the submarkets and view the deal pipeline in a matter of minutes.

There’s no way around it—we’re in a tough environment with high interest rates, a large bid-ask spread, and fewer deals coming to market. But, if you arm yourself with the right AI-driven technology, all deals don’t have to die. You can be the one finding great opportunities and getting those deals done. Contact Archer to learn more.