Dealing with the Real Estate Dry Powder: The Problem with Capital Overhang

Private equity funds are flush with capital, and they keep raising more. When it comes to commercial real estate, all that dry powder makes finding deals even harder than before. And finding them first is critical to deploying capital.

Total dry powder for U.S.-based real estate funds currently hovers around $250 billion, according to Preqin. That represents the highest level in the research firm’s 20 years of tracking real estate market data.

Despite a difficult 2020, real estate assets under management reached $1.1 trillion for the first time in September 2020, according to Preqin. A record number of this amount, 2.7%, is held by secondary strategies.

What is dry powder?

“Dry powder” is an old term that originated from the gunpowder that soldiers used their guns and cannons. Soldiers had to keep the gunpowder dry or else it wouldn’t work when they needed it.

The term is now used in various contexts. For example, in the corporate world, dry powder refers to cash reserves that can be used to weather difficult periods. In the private equity world, including real estate private equity, dry powder usually refers to the amount of capital funds have to available to deploy when an investment opportunity arises.

In general, dry powder is a good thing for real estate private equity funds. It means that funds have plenty of capital to execute their investment strategies. Moreover, it gives them an advantage over other investors when it comes to making acquisitions.

But having too much dry powder – a dry powder overhang – can be a problem. Private equity funds have to balance too little and too much dry powder. Too little and the fund can’t act on good investment opportunities.

Too much means that funds haven’t been able to deploy that capital, either because there’s too much competition, not enough supply, or prices are too high. Or perhaps a combination of all three.

Yield-hungry investors

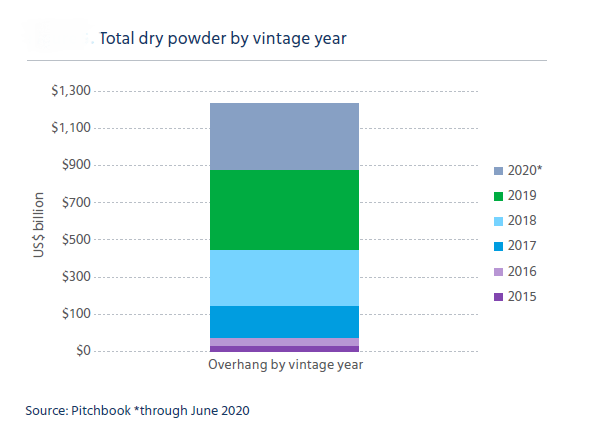

While some real estate professionals blame the pandemic for the dry powder overhang, the fact is, it has existed for several years. Since 2012, the volume of dry powder has exploded.

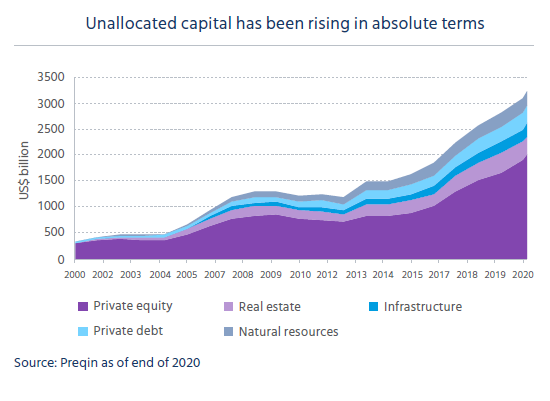

Globally, unallocated funds raised by private equity have been increasing consistently for several decades and reached a record level of US $3.1 trillion in February 2021, according to Mercer. This represents a nine-fold increase over the past 20 years.

Investors, hungry for yield, have poured money into real estate funds over the past several years. For example, between 2015 and 2020, Blackstone raised $65 billion to deploy across all of its real estate funds, according to the 2020 Investor Report by Private Equity Real Estate (PERE). To put these numbers into perspective, in 2010, the entire commercial real estate fund universe consisted of $84 billion of dry powder.

With interest rates so low and yields on other investments compressed, a wide variety of investors are betting on real estate to find the yields they need. For example, a recent Preqin survey found that 45% of institutional investors plan to maintain their allocations to real estate over the next 12 months. Another 36% intend to invest more in real estate.

The COVID pandemic exacerbated the dry powder overhang in commercial real estate, preventing private equity funds from deploying capital. Global commercial real estate transaction volume fell 29% in 2020 compared to the previous year – the lowest level since 2013, according to Real Capital Analytics. The research firm reported that U.S. sales volume fell 32% in 2020 versus 2019.

Large sponsors raise billions

To make the overhang worse, many private equity funds raised capital to take advantage of distressed opportunities. However, that distress has yet to materialize to the degree that people expected or hoped for.

And after a year of value gains in the stock market, allocations are out-of-whack. Asset managers must rebalance their portfolios by increasing their real estate exposure, and they’re doing it by placing money with existing private equity firms, particularly large sponsors with successful track records.

Brookfield Asset Management, for example, plans to raise $100 billion for its next round of flagship funds including the launch of the company’s fourth flagship real estate fund, according to a unitholder letter written by CEO Bruce Flatt.

“The sustained low interest rate environment combined with institutions’ need to earn returns from alternatives has created a very constructive fundraising environment,” Flatt wrote, adding that the management firm is steadily growing its perpetual core private fund products, which take in capital on a quarterly basis.”

Meanwhile, Cerberus Capital Management actually surpassed its fundraising target for its fifth institutional real estate fund. It closed at $2.8 billion, $800 million more than its initial target of $2 billion. It will be used to invest in direct assets, real estate companies, real estate-related debt and entities with significant real estate exposure.

Feeling dry powder pressure

Right now, private equity firms, and real estate-focused private equity, are under tremendous pressure to use their dry powder. Nearly nine out of 10 private equity investors indicate their most important objective is deploying capital, a nearly 10 point increase from 79% in 2020, according to a recent survey of private equity investors conducted by Lincoln International.

Being unable to deploy capital creates real problems for private equity firms. When they’re unable to deploy their capital, they can’t generate any returns for their investors. And when they’re unable to satisfy their investors, those investors will look elsewhere for a home for their money – they’ll want to invest in funds that have shown their ability to find the right deals, regardless of market conditions or competitive landscape.

The pressure to deploy dry powder could lead to subpar deals, which leads to poor investor returns, which leads to investors looking to other fund sponsors to meet their return requirements.

Competing for quality assets

The massive amount of dry powder means that competition for real estate assets is fierce. In fact, competition is so fierce that investors are increasingly willing to take on more risk in order to deploy capital.

The majority of core and core-plus investors expect their unlevered target returns to fall slightly or remain the same, according to CBRE’s Americas Investor Intentions Survey 2021. Roughly 31% of respondents ranked intense competition as the main factor impacting return expectations.

With so much competition for deals, what can real estate investors do to deploy capital? They can bolster their own acquisitions team and gain an advantage by partnering with Archer and harnessing AIM, the company’s proprietary technology platform.

Developed by Archer’s innovative data science team, in partnership with savvy real estate professionals, AIM helps investors source strategic investment opportunities by converting raw, disjointed data into actionable market intelligence.

AIM gives real estate professionals a competitive edge by providing visibility into market dynamics and property type performance. Armed with AIM, investors can discover market transactions and move faster and earlier than the competition.

There’s no sign that today’s supply-demand imbalance is going to abate, which means that real estate investors need to find more supply and more sellers. Archer and AIM can help.