What you miss with back-of-the-envelope calculations

You can’t underwrite every potential deal yourself. The very notion—spending hours evaluating each possibility—is ludicrous. (If you have that kind of time, you’re either living in a different reality than the rest of us or you’re some kind of time-management guru whose self-help book we need to read immediately.) Most of us need shortcuts.

Even though underwriting is the only way to get a true sense of the value of a multifamily property, many investors rely on back-of-the-envelope calculations to assess a deal. One common approach is to take rents and the property size, get revenue from that, and then apply a margin (say 65%) to get net operating income (NOI). Divide that NOI by a target cap rate, and viola! You’re done.

It’s fast. It’s easy. And it gives you a pretty good sense of the property’s value. Right?

Well, maybe not.

When you take shortcuts, you miss variables, and those variables may make the difference between a deal you’d be wise to pass on and one you’d regret never exploring if you ever knew how good it could be. They may also lead you to waste time on deals that crumble upon closer inspection. Here’s why.

The NOI margin problem

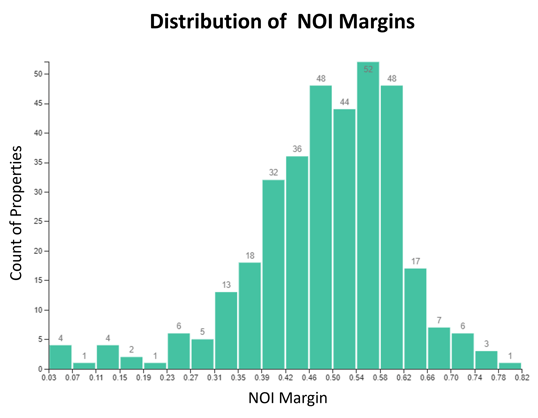

Because we’re curious people with a powerful platform that can process data incredibly quickly, we decided to calculate the actual NOI margins for a random sample of over 300 deals that came out over the two years. What we found was a huge range of NOI margins.

Take a look at these margins. The vast majority are below 60%, with a mean of 49%, a median of 51%, and as standard deviation of 13%.

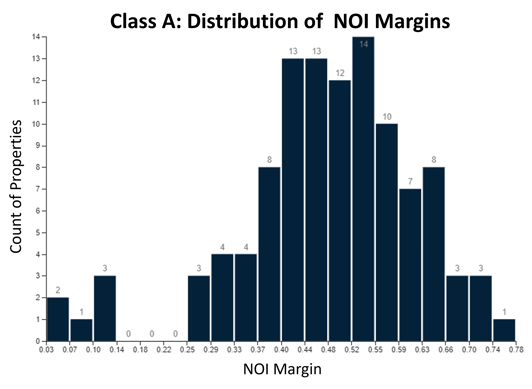

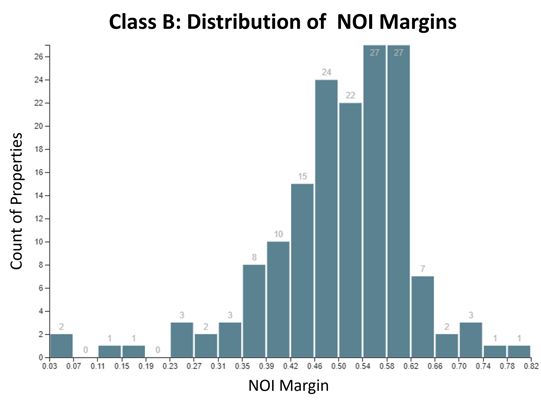

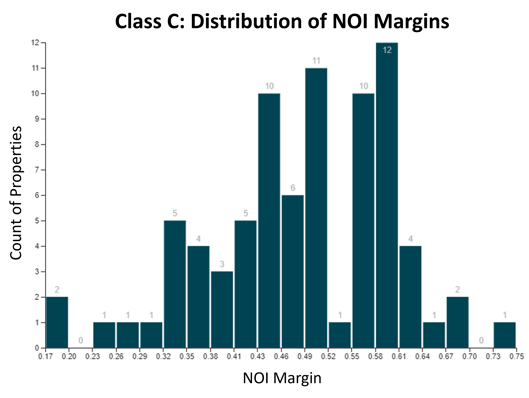

Even broken out by property class, you can see substantial ranges in NOI margins.

So what does this mean for you? If you’re applying a uniform NOI margin to your calculations, you’re missing valuable data. Even if you use the mean or median, there’s a good chance you’re getting an inaccurate calculation.

External variables

You’re also missing critical information from variables outside the simple calculation. Your back-of-the-envelope numbers won’t tell you if there’s an opportunity to improve the performance of an asset. It won’t tell you if the environment is rapidly changing. And it won’t tell you if the seller may be open to off-market deals due to success or financial distress.

Here are a few key variables that affect the actual value of an asset, which you can’t see in basic calculations, even with the most accurate of NOI margins.

Operational line items you could modify

Without underwriting, you have no concept of how this property is being managed. An asset may not appear valuable on the back of the envelope, but there could be any number of operational reasons for that. Reasons you could change. Reasons that make a property an unrealized diamond in the rough.

Your calculations won’t show you the operating expenses you could modify to make a property more profitable, which means they won’t tell you when an asset is under-priced. This applies not just to marketed deals but also to marketed opportunities.

Rapidly changing environments

Rapidly changing environments create off-market opportunities if you’re aware of them. In a growth environment, where rents are growing faster than expected, current owners are likely to hit their investment return expectations faster than expected. They may be open to an early sale if approached by an eager buyer.

On the flip side, environments like rising interest rates or rising collection losses (like we saw during COVID-19 lockdowns) can create financial distress for properties. This could be adding pressure to sell or recapitalize.

If you’re using back-of-the-envelope calculations on these properties, you may never see these situations or realize the magnitude of the rise or fall, which means you might miss some valuable off-market opportunities.

Beyond off-market deals, during times of rapid change, the variables you miss or include become exacerbated, which leads to even more faulty decisions resulting in false negatives (deals you think are bad but are good) and false positives (deals you think are good but are bad).

An algorithmic answer

In an ideal world, you’d underwrite every potential deal to uncover these variables and get an accurate idea of each asset’s value. Since it’s not feasible to do this yourself, we created an algorithm to do it for you.

With our Automated Underwriting solution, simply enter an address and receive a detailed underwriting model in two minutes. You’ll get detailed financial, rent and sales comparisons that provide far more value than any back-of-the-envelope calculation. Then, spend 10 minutes calibrating it, and you’ll have a fully built out model that would’ve taken you days. It’s that easy.

If you’re tired of missing opportunities and wasting time on deals that aren’t a fit, get in touch with us so we can show you how it works. You won’t be disappointed.