Not All SOC 2 Is Created Equal: How Archer Built Trust Into The World’s Leading Real Estate Intelligence Platform

Setting a new standard for security in real estate intelligence — where data moves seamlessly across parsing, Excel, and AI, without ever compromising trust.

Delivering Intelligence with Integrity

At Archer, trust isn’t a checkbox — it’s the foundation of real estate intelligence.

We’re proud to announce that Archer has achieved SOC 2 Type II compliance, validating that our controls meet the highest standards for security, availability, and confidentiality under the AICPA Trust Services Criteria.

But here’s the truth: not all SOC 2s are created equal.

Why This Matters — and Why Archer Customers Are So Excited

For most CRE technology vendors, SOC 2 compliance covers a single, static application or a one-way data pipeline.

For Archer, it covers something far more complex — a live intelligence engine that securely connects, processes, and learns from data flowing in every direction.

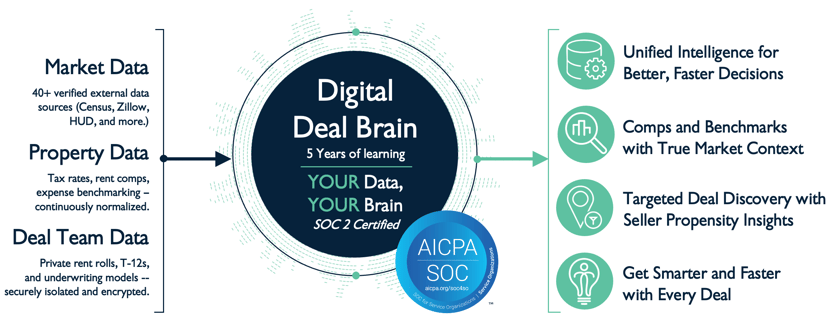

Our architecture spans:

- Excel add-ins, parsing infrastructure, and in-app analysis workflows

- 40 + verified external data sources, from HUD and Zillow to Census Bureau datasets

- Customer-owned rent rolls, T12s, and underwriting models

- A continuously improving AI-driven Digital Deal Brain that gets smarter and faster with every deal (more on this below)

This interconnected ecosystem — spanning ingestion, parsing, modeling, and predictive analytics — is what makes Archer’s platform so powerful. It’s also what makes achieving SOC 2 compliance exponentially more challenging — and impressive.

Today, leading firms such as Marcus & Millichap, Mesa Capital Partners, Lincoln Property Company and RPM rely on Archer to parse, underwrite, and analyze deals — with confidence that their data is protected by enterprise-grade security.

“Not all SOC 2s are equal. Ours covers a live, multi-system intelligence network — parsing, Excel, predictive modeling — all working together in real time. That’s what makes Archer different. It’s why we’re the only platform capable of building the Digital Deal Brain — and why our customers can innovate with complete confidence.”

- Thomas Foley, Co-Founder & CEO, Archer

Inside The Archer Digital Deal Brain

At the center of Archer’s platform is the Digital Deal Brain — the intelligence layer that helps deal teams move faster and smarter across the CRE investment lifecycle.

It’s trained to read operating statements, interpret rent rolls, and instantly benchmark property performance against tens of thousands of public-data comps, enabling every customer — whether you’ve been with Archer since the beginning or you’re just getting started — to benefit from a foundation of proven data, context, and predictive insight from day one.

For new customers, that means instant access to the collective intelligence Archer has already learned from public data: how expenses normalize, where rent growth accelerates, how taxes and insurance trend by market — insights that would otherwise take years of deal data to build.

For long-standing customers, the Digital Deal Brain only gets sharper — learning from your deal flow and returning contextually relevant insights unique to your portfolio and strategy.

The system continuously learns from public market and property data — insights every customer benefits from — while private deal team data and user behavior remain fully isolated, shaping predictions only for your organization.

Here’s how it works:

-

Public Market & Property Data – The most relevant publicly available data — including county records, taxation estimates, submarket performance with forecasted completions, rent comps, expense benchmarks, sale records, and more.

-

Private Deal Team Data – your private rent rolls, T12s, and models feed your own secure Digital Deal Brain.

-

AI Learning Layer – Archer continuously learns from anonymized patterns while keeping every customer’s proprietary data fully isolated, private and encrypted.

That means the system doesn’t just process your data — it remembers how you work.

For example, if a user adjusts how payroll expenses should be categorized or overrides an assumption for property tax growth in a specific market, Archer takes note.

The next time a similar T12 or market appears, the Digital Deal Brain automatically applies that same logic — saving analysts time and ensuring future analyses stay consistent with your team’s preferred approach.

That’s intelligence with integrity — AI that gets smarter, while your data stays yours.

A Secure Foundation for the Future

With Archer’s compliance now validated, we’re continuing to expand the boundaries of CRE intelligence — delivering automation, analytics, and predictive insight on a foundation of verified trust.

Archer’s commitment to security, transparency, and intelligence isn’t a milestone — it’s a mindset. Because when your data is secure, your intelligence can go further.

To download a copy of Archer’s SOC 3 report click HERE.